Thriday, a financial management platform for SMEs, has collaborated with Experian to revolutionise financial administration for businesses. Thriday’s unique product automates banking, accounting, and tax for small businesses, helping them save time and costs. The integration of Experian Look Who’s Charging’s technology, which enriches and automatically categorises bank transactions in real-time, has enabled Thriday to offer its customers a more accurate and faster bookkeeping service than human labour. By charging users just $29.95 a month, Thriday has slashed the costs of financial administration for businesses while also saving them six hours of precious time each week.

See full story >Overview: NAB transforms personal banking app

How an Australian-first collaboration between Experian and NAB became an industry standard

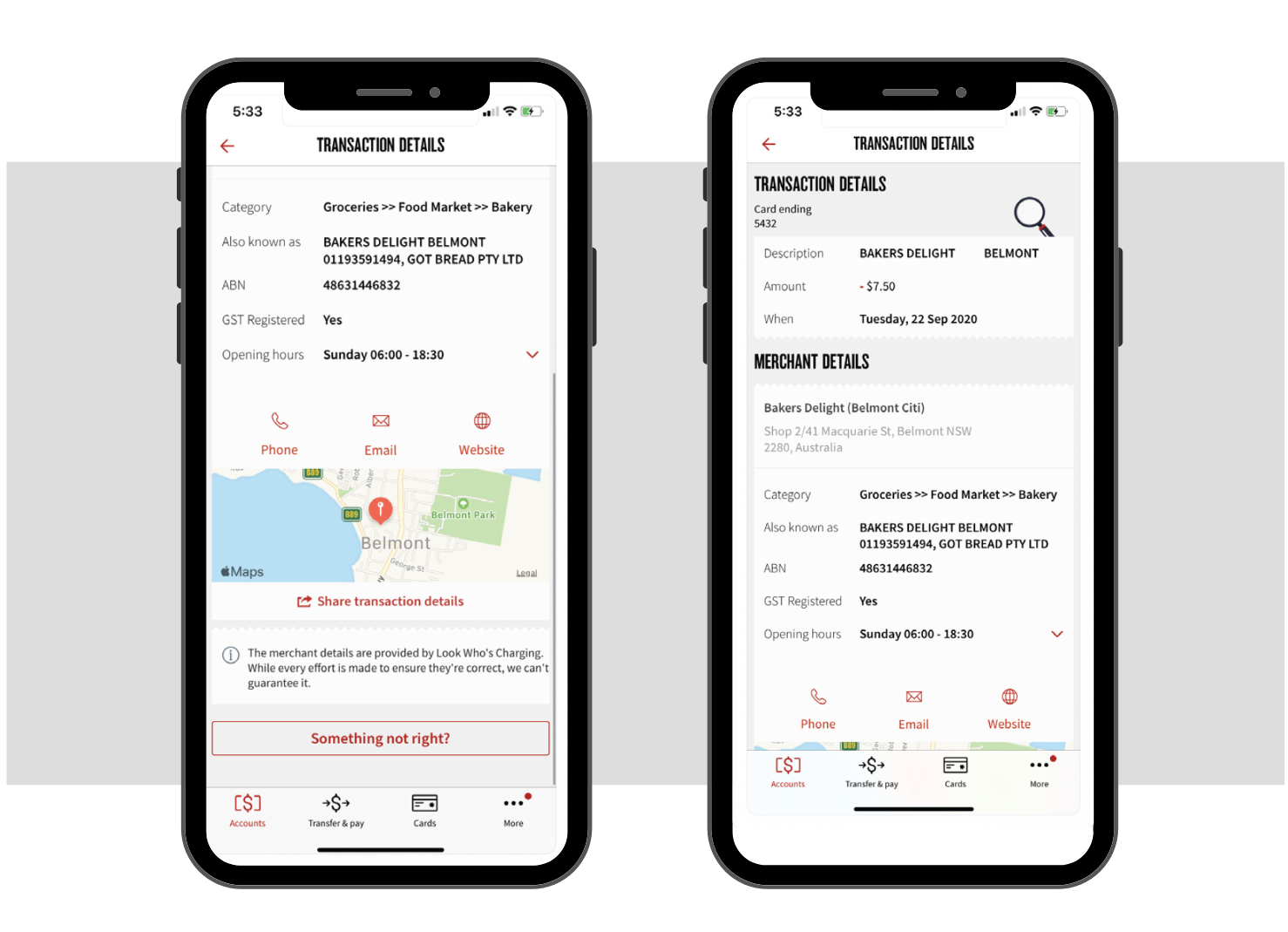

In 2017 NAB leveraged Experian, powered by Experian Look Who’s Charging, to transform the digital banking experience and became the first major bank in Australia to provide their customers easily identifiable transaction data. Traditionally, cryptic transactions on bank statements led to customer confusion and chargebacks. NAB aimed for granularity to empower customers to better manage their finances. Recognisable merchant details replaced confusion, reducing contact centre calls. Awards followed including Money Magazine’s Most Innovative Banking Feature. The collaboration spurred further innovations like NAB’s spending tool, providing customers insights into their expenditure.

Challenge overview

Some months, a glance at your credit balance can make you spill your coffee. Why was August double my usual total? It could be that car service, a particularly busy month of birthdays or a new home insurance premium. Traditional bank statements can make it hard to see where exactly your money went.

For example, the KFC restaurant in Fairfield appears as RSJ FAMILY PTY LTD SYD. Australian banks receive millions of calls each year questioning the origins of a transaction and more often than not, they have no more information to work with than the consumer. Many of these calls result in an inconvenient and costly chargeback that can involve cancelling and reissuing the customer’s card.

In 2017, NAB decided it was time for an improvement. A better level of granularity would help customers better manage their finances and this ability to self-serve would allow the bank’s staff to get back to supporting people who really need it. So, NAB became the first major bank in Australia to partner with Experian, to provide their customers with easily identifiable transaction data.

National Australia Bank (NAB) is one of Australia’s four largest financial institutions and Australia’s largest business bank. NAB employs more than 32,000 people and supports more than 8.5m customers in Australia and overseas across personal accounts, small, medium and large businesses, private clients, government and institutional activities.

| Industry: | Financial Services |

Solution overview

From first meeting to market in record time

NAB had a clear goal in mind, and Experian had the expertise and solution to reach that goal. This shared vision and a commitment to partnership helped expedite implementation and the technology was in market within a record eight months.

NAB’s customers no longer have to decipher cryptic statements. Instead, they are shown a recognisable merchant name, location and a meaningful spending category. Calls to the contact centre have reduced significantly, and the bank has been awarded numerous awards for their use of the technology including Money Magazine’s Most Innovative Banking Feature and the Best Bank/FinTech Collaboration award at the Annual Australian FinTech Awards.

Stuart Grover, Experian Look Who’s Charging’s Co-founder and CTO at the time, said “Australians waste millions of hours trying to figure out who has charged their card. Our work with NAB means customers can have the information they need at their fingertips.”

Emily Nicholas, NAB’s Head of Digital Enablement, added “As a bank, our core competency and focus is financial services, hence our collaboration with Experian for data enrichment. Our job is to then do something powerful with the data to improve the experience for our customers.”

A catalyst for innovation

Financial anxiety remains top of mind for many Australian consumers and businesses alike. Experian’s Global Insights Report revealed that since COVID-19 the number of Australians that cut back on discretionary spend had more than tripled and the number of Australians that cancelled subscriptions or memberships had more than doubled. Australian businesses also faced challenges, with over a third indicating they needed to adjust operations to better support customers. Banks are therefore having to find new ways of giving customers better visibility over their spending and letting them self-serve to free up contact centres to prioritise hardship requests. NAB’s partnership with Experian accelerated these innovations.

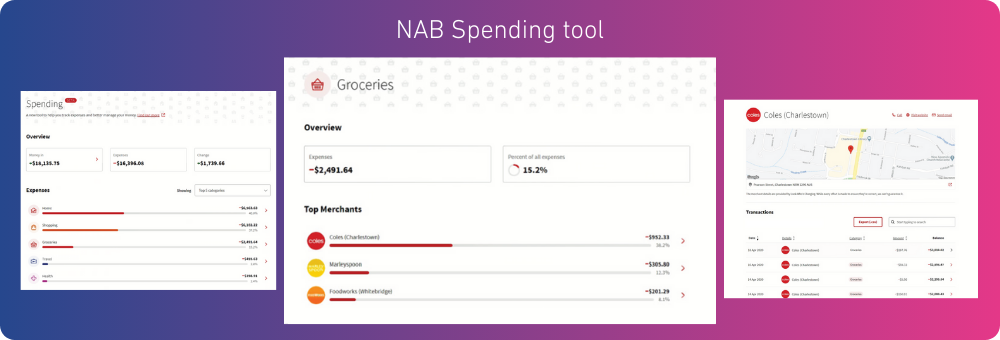

NAB’s new spending tool is one such example. Enabled by Experian’s data, the tool helps NAB’s customers better understand where their money is going, making it easier to monitor a budget and savings plan.

“NAB and Experian have grown together. As Experian have evolved their offering, we’ve evolved our ability to support customers with new tools and services. Our relationship has proven that large enterprises and startups can co-exist in the same ecosystem if we’re both focused on the same goal – a better, more empowering banking experience for all.” – Emily Nicholas, Head of Digital Enablement at NAB

- Improved user experience with enriched bank transactions for instant clarity on spend

- Significant reduction in calls to the NAB contact centre

- Accelerated other innovations such as NAB’s ‘Spending’ tool

Would you like more information?

Speak to an expert