Thriday, a financial management platform for SMEs, has collaborated with Experian to revolutionise financial administration for businesses. Thriday’s unique product automates banking, accounting, and tax for small businesses, helping them save time and costs. The integration of Experian Look Who’s Charging’s technology, which enriches and automatically categorises bank transactions in real-time, has enabled Thriday to offer its customers a more accurate and faster bookkeeping service than human labour. By charging users just $29.95 a month, Thriday has slashed the costs of financial administration for businesses while also saving them six hours of precious time each week.

See full story >Overview: Data Action enhances banking apps for mutual banks

One step closer to self-service for Australia’s mutual banks

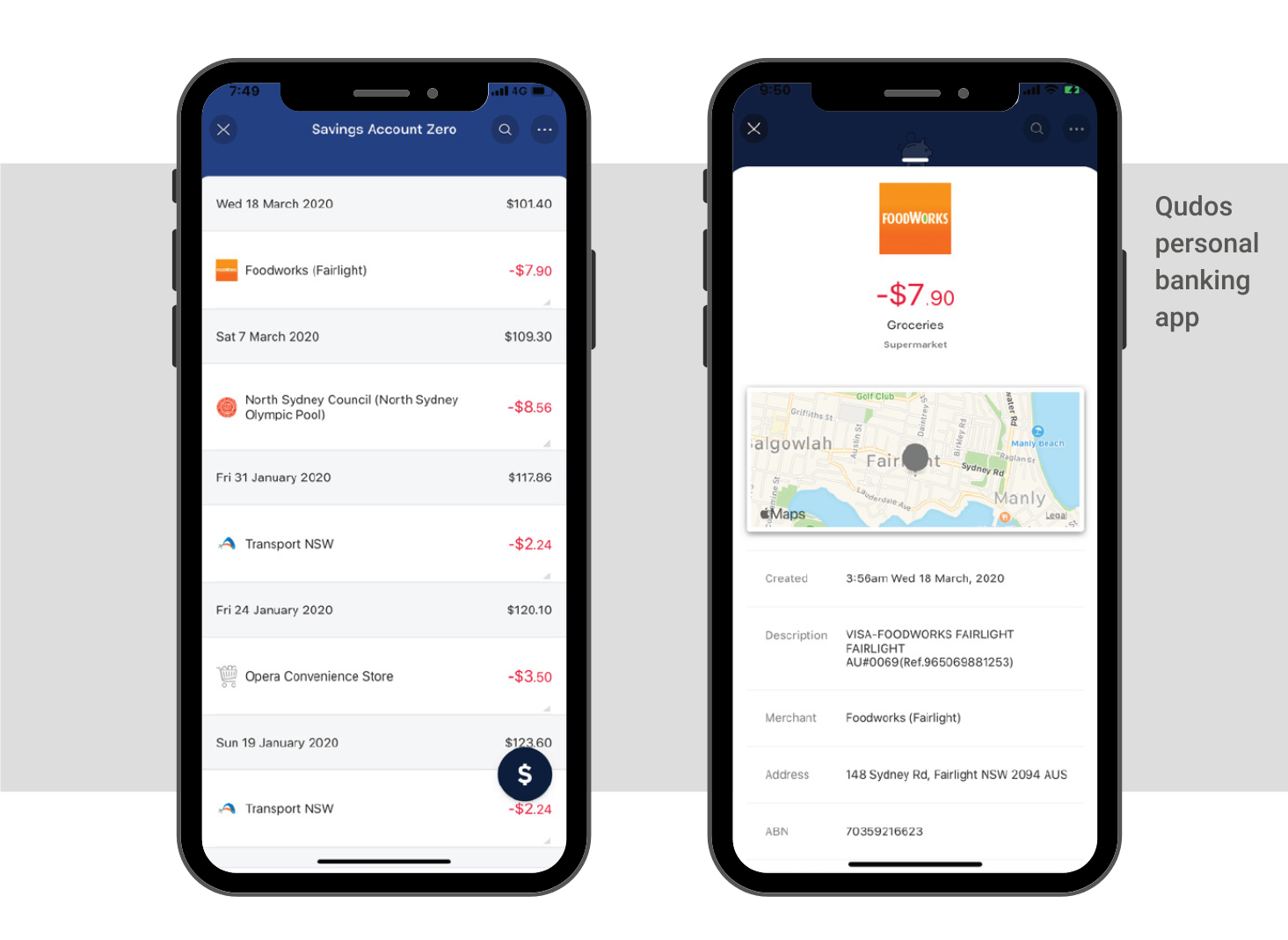

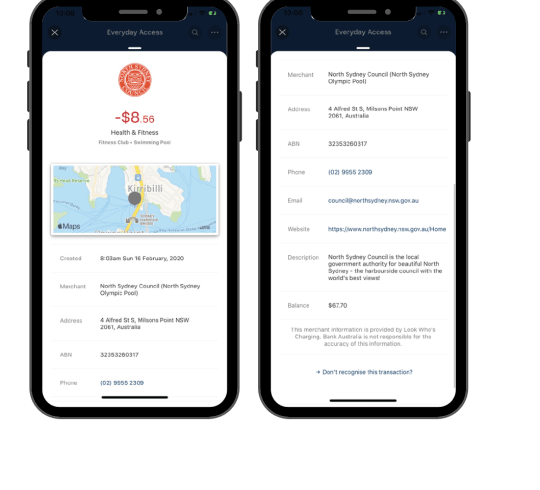

In response to heightened customer expectations for enhanced self-service in the digital finance realm, Data Action, a leading tech provider for Australia’s mutual banks, collaborated with Experian, powered by Experian Look Who’s Charging. The cooperation aimed to revamp the presentation of transaction data in digital banking applications, enabling the banks’ customers to easily decipher transactions and aligns with Data Action’s long-term goal of providing holistic Personal Financial Management (PFM) capabilities. Experian’s technology has been integrated into several mutual banks’ applications, streamlining processes, and improving customer service.

Challenge overview

In an increasingly digital financial landscape, it’s not surprising that customers are expecting better self-service capabilities from their banks. They want to be able to answer their own questions, understand their finances at a glance and better manage their money – especially after years of economic uncertainty. Experian’s Global Insights Report highlighted that Australian consumers are conducting more personal banking activities online than pre-COVID-19 times, and more than half now have higher expectations about customer experiences delivered online.

Historically, transaction data on bank statements has often looked unrecognisable, with merchant names or locations seemingly incorrect and no way for customers to know what they purchased. With over 1.2 million card-accepting merchants in Australia, 60,000 new merchants each year and hundreds of millions of ways that transactions can appear on a statement, cleaning up this data is a complex challenge.

It was a challenge Data Action – the leading tech provider for Australia’s mutual banks – saw as imperative to address on their journey of building a more holistic PFM solution. So, they decided to partner with a cutting-edge provider who could help solve the problem.

Data Action (DA) is a specialist software and services provider to the alternative banking and financial services industry. With a focus of supporting the financial wellbeing of Australians, DA enhances the banking experience of more than a million Australians via its core banking and digital platforms every day. With over 30 years’ experience, DA represents over $33 billion in client assets, operates nationally and services a broad client base including customer owned banks, credit unions, neobanks and financial services membership organisations.

| Industry: | Financial Services |

Solution overview

Co-designing a path to PFM

In collaboration with their major banking clients, Data Action leveraged Experian to change the way transaction data appears on their clients’ digital banking applications.

Now, consumers can click on unfamiliar transactions to access more meaningful information – including a trading name, location and category of purchase.

The solution marks a key step on Data Action’s roadmap to delivering more holistic PFM capabilities. This long-term goal was the core driver, but the collaboration with Experian has had immediate benefits too.

“Our clients love to put the power of banking into the hands of their customers,” said Data Action’s Kevin Atkinson, Product Manager Staff Channels (Core Banking and CRM). “We see the integration of Experian’s data as a key stepping-stone towards being able to give our clients deep and holistic insight into their spending habits, from categorisations to predictions, and ultimately allowing them to better manage their money.”

David Washbrook, General Manager and Co-founder of Experian Look Who’s Charging at the time added, “There are enough things to worry about in these uncertain times, and a transaction you don’t recognise shouldn’t have to be one of them. Experian allows customers to easily see where every transaction was made and to who. That takes the guesswork out of unrecognisable transactions and prevents calls back to customer service.”

Automatically enrich and categorise bank transactions in real-time for faster and more accurate decisions

Learn moreA mutually beneficial collaboration

Experian’s technology was integrated in record time, with the banking applications of seven leading mutual banks including Bank Australia, Qudos Bank and Credit Union SA, a task that wouldn’t have been possible without the Data Action partnership.

In addition, alleviating administrative pressure on internal teams has been crucial in a year where customer queries have significantly increased and work practices have been disrupted, allowing Data Action’s clients to focus on better supporting their customers who really need financial help.

- Instant clarity on spend in real-time

- Improved customer experience and instant clarity on spend in real-time

- Alleviated administrative pressure on internal teams

Would you like more information?

Speak to an expert