In today’s rapidly evolving digital landscape, transaction enrichment has emerged as a powerful tool for banks and fintechs to unlock deeper insights from transaction data. Transaction enrichment, the process of augmenting raw transaction data with additional context and insights, holds tremendous potential. This article delves into the transformative impact of transaction enrichment, with a specific focus on enhancing consumer financial wellbeing, how it helps organisations make better decisions and drives innovation.

Understanding transaction enrichment

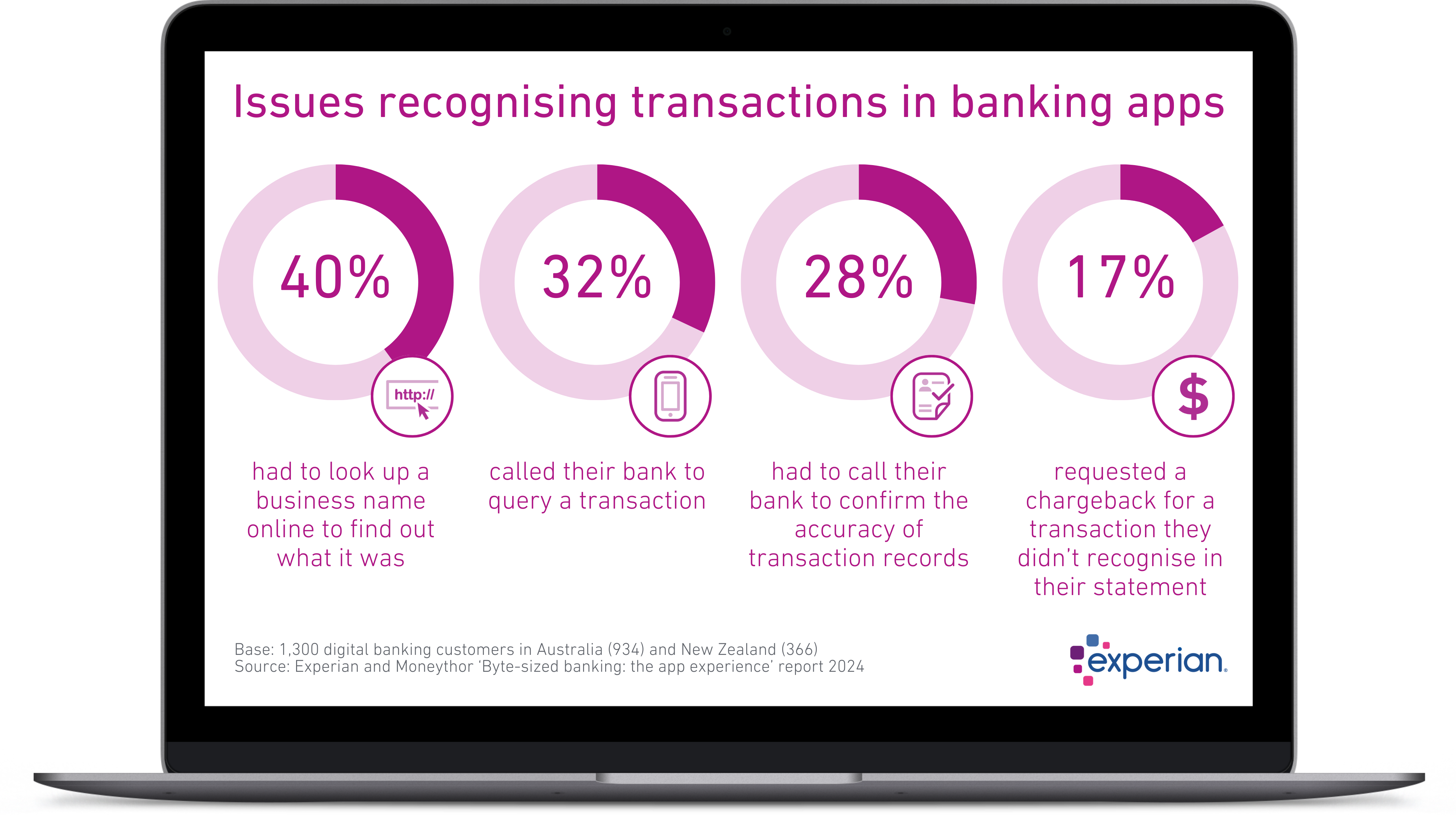

Transaction data can often be confusing for customers as well as expensive and time consuming for banks to resolve queries and glean insights from. Experian and Moneythor’s recent research report Byte-sized banking: The app experience revealed that 73% of Australian and New Zealand digital banking customers surveyed experience issues recognising transactions in their bank’s app.

Issues recognising transactions are even more pronounced in the tech-savvy and heavy bank app user demographic of 25-34-year-olds. They are the most likely to check their transactions and follow up on anything that looked unusual, such as searching for a merchant’s business name (41%), calling their bank to confirm the accuracy of transaction records (36%) and requesting a chargeback (20%).

The deceptively simple solution is transaction enrichment. This involves enhancing basic transaction data with additional contextual information, such as company trading name, logo, geolocation information, category etc. Transaction enrichment isn’t just about adding more data – it’s about leveraging that data to gain valuable insights that can help consumers improve their financial wellbeing and help businesses make better decisions.

Empowering success through transaction enrichment

Transaction enrichment has helped to transform the financial services landscape, offering enhanced capabilities that empower both consumers and businesses alike. By leveraging enriched transaction data, organisations can drive better financial literacy, enhance user experiences and fraud detection, streamline operations and gain deeper insights for better decision-making.

Strengthening financial literacy and wellbeing

Transaction enrichment contributes to improving financial literacy and wellbeing in several key ways:

- Enhanced financial awareness – By providing detailed insights into spending habits and financial behaviours, consumers are able to make more informed financial choices.

- Budgeting and planning – Personal finance management (PFM) tools powered by enriched transaction data enables consumers to gain a holistic view of their financial habits, track spend patterns, set realistic budgets and track their progress, promoting responsible financial management and long-term savings goals.

- Personalised and proactive financial support – With personalised recommendations based on enriched transaction data, consumers can access more tailored financial services and support that meet their specific needs and aspirations.

Experian and Moneythor engaged 1,300 digital banking customers across Australia and New Zealand to get the lay of the land when it comes to their banking app experiences.

Download the reportEnhancing the user experience

In the fast-paced world of digital transactions, a strong user experience (UX) is key to customer satisfaction. One crucial aspect of enhancing digital banking UX lies in transaction enrichment, where clarity and context play pivotal roles.

Enriched transactions allow customers to see detailed, easily understandable transaction information in real-time that not only includes more comprehensive details of a merchant at an individual level and clear, concise descriptions to eliminate confusion, but also enriches the experience with more context through in-depth categorisation. Among the Byte-sized banking: The app experience report respondents whose banks use Experian for transaction enrichment, 82% reported they were satisfied of extremely satisfied with transaction clarity, compared to 70% among those whose banks do not use Experian.

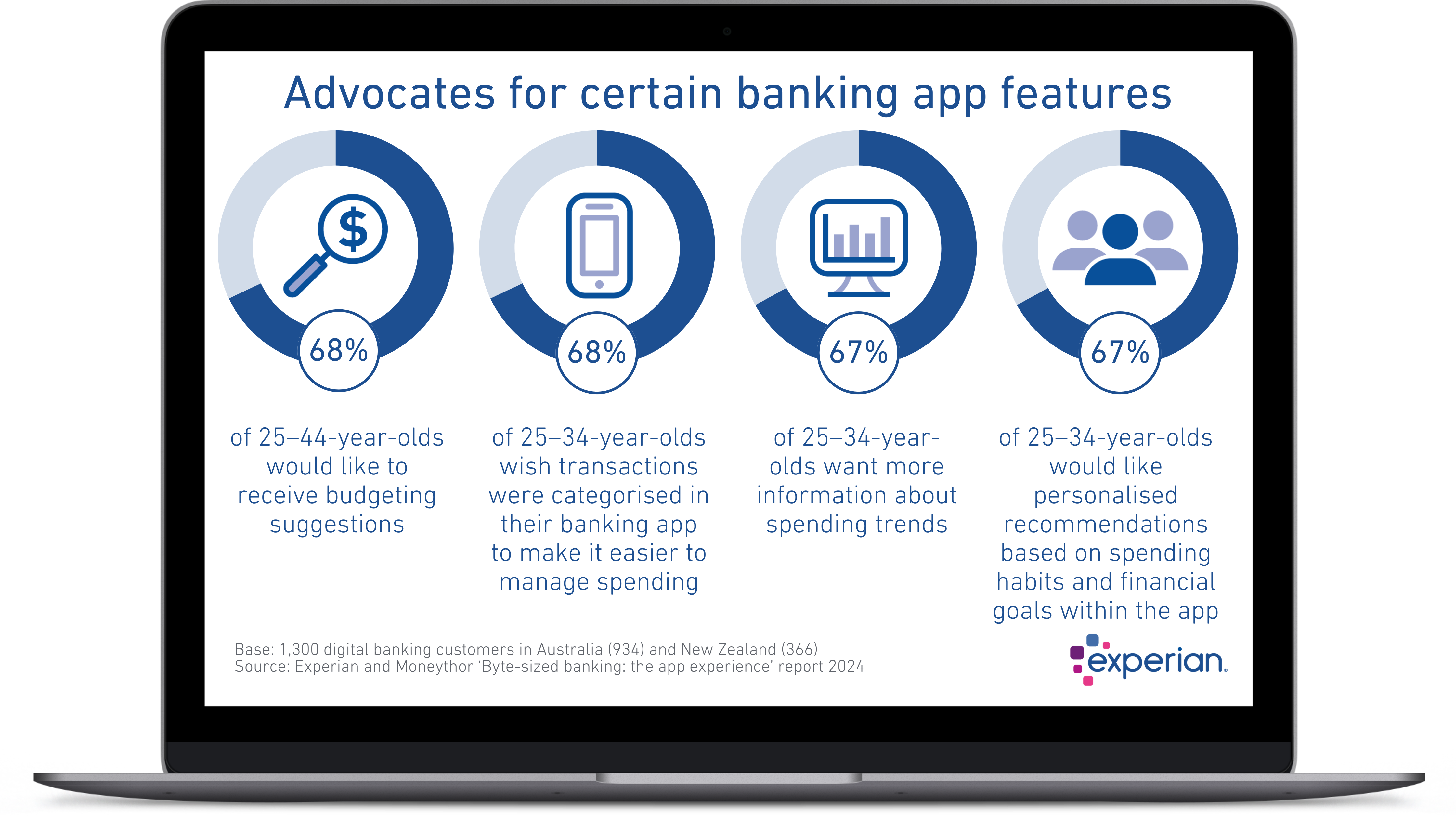

The Byte-sized banking: The app experience report also reveals that digital banking app users increasingly seek proactive tools and insights to help them better manage their finances. Not surprisingly, it’s 25-34-year-olds who are the most vocal about what they want to see.

Transaction enrichment underpins the many features desired by users.

Driving operational efficiency

The Byte-sized banking: The app experience report revealed that 32% of respondents called their bank to query a transaction and 17% requested a chargeback for a transaction they didn’t recognise. Transaction enrichment plays a key role in driving operational efficiency by enabling organisations to streamline operations through increased self-service capabilities.

By providing comprehensive merchant details alongside intuitive interfaces, businesses can empower customers to resolve transaction queries independently, reduce the need for customers to contact them for support and decrease chargebacks. Among respondents whose banks use Experian for transaction enrichment, only 11% reported requesting a chargeback for unrecognised transactions, compared to 17% among those whose banks do not use Experian. More broadly, Experian clients have seen that:

- Call centre traffic due to “transaction not recognised” queries may be reduced by up to 50%

- Chargebacks due to “transaction not recognised” queries may be reduced by up to 25%

Streamlining fraud

The Byte-sized banking: The app experience report revealed that 60% of digital bank app users expect their bank to alert them when there’s an unusual transaction or fraud risk. Transaction enrichment plays a critical role in this area by enabling better detection of anomalies and facilitating the verification of suspicious transactions in real-time. Enriched transaction data helps businesses identify patterns in typical user spending and flag deviations that may signal potential fraud. Additionally, immediate verification processes such as two-factor authentication or transaction confirmation prompts can be enabled as an extra layer of security.

Enhancing business intelligence and analytics

In the era of data-driven decision-making, business intelligence and analytics are key in shaping strategies and driving growth. Transaction enrichment serves as a valuable tool in this regard by unlocking deep insights into consumer behaviour and preferences. These comprehensive insights enable businesses to:

- Better identify opportunities within their customer base

- Optimise and personalise financial product offerings

- Personalise support and services

- Better mitigate risks

Transaction enrichment in action

Trusted by more than 30 banks and fintechs in Australia and recently expanded to New Zealand, Experian’s transaction enrichment solution has been instrumental in helping to transform the digital banking customer experience. Explore some key case studies where transaction enrichment has made a significant impact:

- Experian powers transaction clarity in ANZ apps

- Experian helps NAB transform digital banking

- Experian and Data Action power financial autonomy

If we can assist your business in providing greater clarity of transaction data, please get in touch with us using the form below.