The updated Mosaic provides a detailed perspective on broader consumer trends, adding colour to our view of Australian Households. One of the most insightful and valuable aspects of Mosaic is its capacity to detect key demographic trends and challenge some of our assumptions.

Redefining the renters

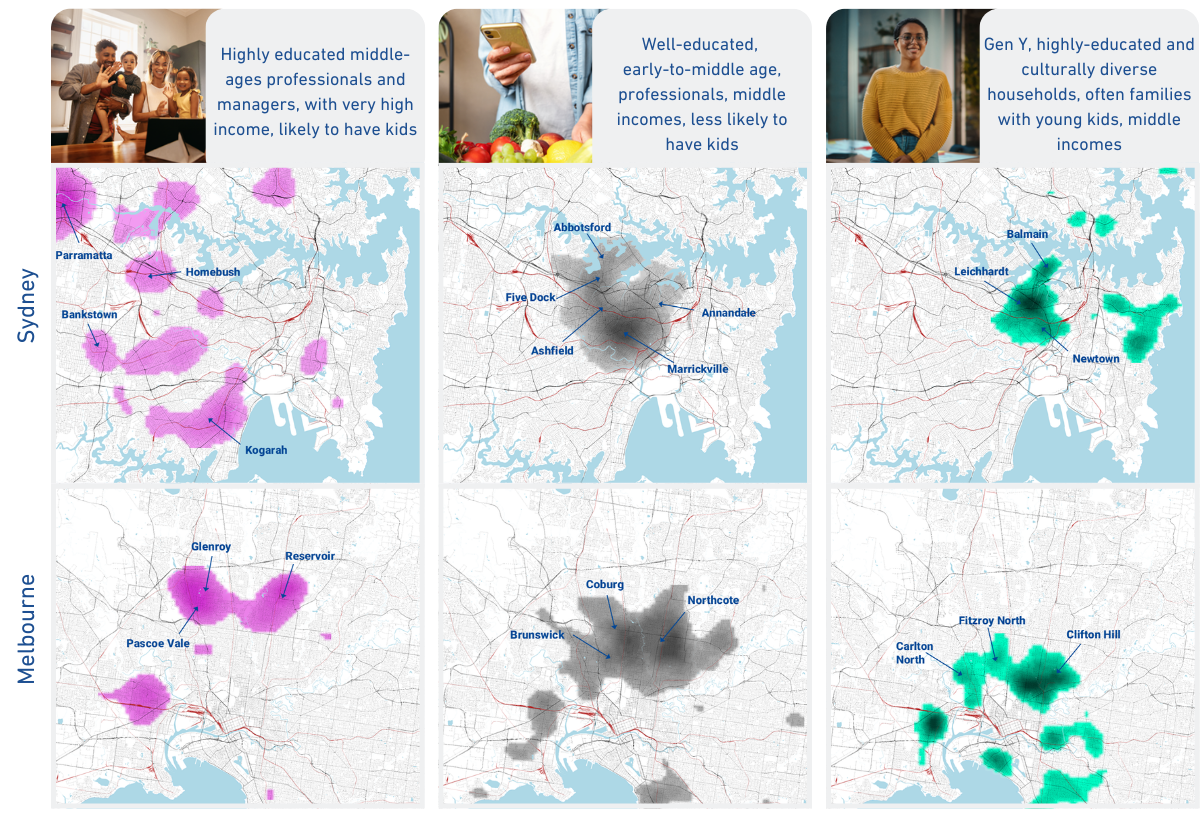

Desirable inner-suburban areas, once predominantly occupied by renting singles and couples, now attract a more diverse range of tenants. In 25 years, the proportion of Australians renting has climbed steadily from 18% to 26%. An increase in older (aged 35-54), higher-income renters is primarily responsible for this rise, which contradicts the typical perception of renters as young and on lower incomes. 1

Surging rents and above-average population growth in areas like Melbourne’s northern corridor have shifted rental demographics. Higher-income families are choosing to rent in inner-to-middle ring suburbs, while others are moving further out.

Where renters’ money goes

What are they spending on and what won’t they give up?

Renters are spending on overseas holidays, fitness and gym memberships, premium or organic food, and investments.

It’s important for our clients to consider these segments and tailor offerings for them such as:

- Financial products for investors

- Mortgage facilities for those looking to buy their first home

- Entertainment options for families who want the inner-city lifestyle

- High-end retailers for high-income renters with higher liquidity

Segments hardest hit by the rising cost of living

The recent Mosaic rebuild provides a timely opportunity to address the significant impact of Australia’s rising cost of living over the past few years.

Mosaic can help pinpoint various forms of financial strain that different segments of the population may face, revealing how and why these segments are experiencing financial pressure, which ultimately influences their spending decisions.

Among those most severely impacted by financial hardship are families with mortgages.

This is because households have been struggling to keep up with the fastest interest rate hikes since the 1980s. As a result, working mortgaged families have felt the biggest impacts.

However, top forecasters expect interest rates will start to fall in 2025, offering a potential glimmer of hope for these families.2 Fortunately, the first of these has arrived in February, with the official cash rate being reduced by 25 basis points.

Which segments have been most impacted?

Themes

High-income, but low-wealth, millennial families who are culturally diverse with young children. They recently bought larger homes in high-growth areas of Melbourne and Sydney. Many are professionals and managers.

H25- New Kids on the Block

Young families and solo parents with young children, living in new housing estates on the outskirts of metropolitan areas. Predominantly blue-collar workers with average incomes, recently moved into smaller properties (e.g. townhouses) on new housing estates in high-growth areas.

The family on the left (E15 – Brave Beginnings) is more likely to be culturally diverse, with high income but low wealth, particularly professionals and managers with bigger properties. Living next door, on the right, we have middle-aged families (H25 – New Kids on the Block), often working in blue-collar jobs and earning above-average incomes.

What are the similarities? Both families have recently moved into newly bought properties in high-growth areas and have high mortgage payments with low net assets. This combination can make them financially stressed.

How to engage with these segments

When working with these segments, we’d suggest you consider their wellbeing and have empathy. While they may not be your best customer today, this is likely to be temporary.

Interactions with brands will have a lasting impact.

In the utilities industry, providing support to customers facing financial challenges can foster enduring loyalty.

For retailers, special-occasion purchases are critical right now. Customers who have positive experiences with less frequent transactions are likely to remain customers in the long term.